Save on your income tax

BECOME A CYPRUS TAX RESIDENT

Cyprus tax residency gives the opportunity to any individual to benefit from Cyprus Income tax on his/her worldwide income, with no obligation to live in the country.

Apply for Cyprus Tax resident and never worry about your tax again.

Reduce your tax on your worldwide income.

Fast application process. Start saving the soonest.

Work from anywhere in the world. No need to reside in Cyprus all year round.

No documentation fuss. We will handle everything.

Benefits of Cyprus Tax Residents.

A Cyprus tax resident is taxed on all the income from sources within or out of Cyprus. A non-Cyprus resident is taxed on certain income collected from sources in Cyprus.

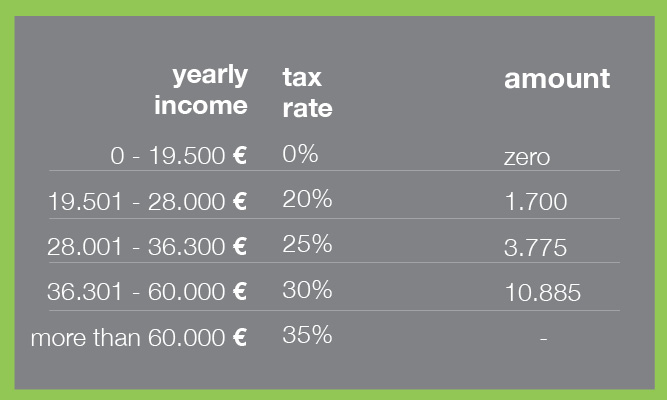

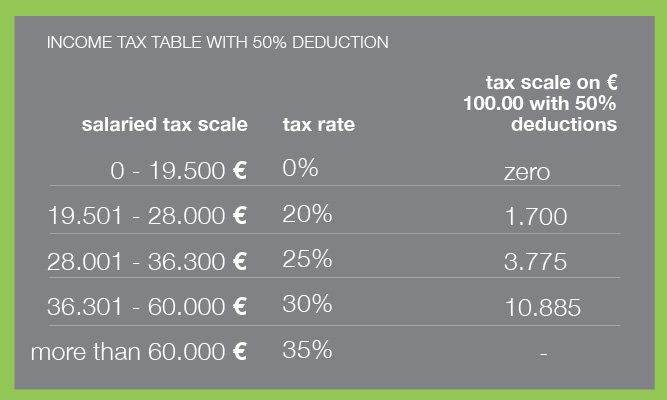

50% Tax Deduction Is Provided On Remuneration From Any Employment Exercised In Cyprus By An Individual Who Was Not A Resident Of Cyprus Before The Commencement Of The Employment And With Annual Income Of Over €55.000

From 2022 Onwards. The Exception Is Provided For 17 Years From The Year Of Employment.An alternative of 20% exemption is also valid for 3 years if employee annual remuneration is less than €100.000

The following are deducted from your income

- Contributions to trade unions or professional bodies – The whole amount

- Rental income – 20% of rental income (for income tax

purposes) - Donations to approved charities (with receipts) – The whole amount

- Social Insurance, medical fund (maximum 1,5% of remuneration), pension

and provident fund contributions (maximum 10% of remuneration) and life

insurance premiums (maximum 7% of the insured amount) – Up to 1/5 of the chargeable income - Amount invested as from 1 January 2017 in an approved innovative small

and medium sized business either directly or indirectly (applicable up to 30

June 2021) – Up to 50% of the taxable income as calculated prior to this deduction (subject to a maximum of €150.000 per year). Unused deduction can be carried forward and claimed in the following 5 years subject to the above maximum. - Costs incurred for research and development – A higher deduction amounting to 120% of the expense is expected to be available soon.

How can someone become a Cyprus Tax Resident?

An individual is considered tax resident in Cyprus if he/she spends in Cyprus more than 183 days in any calendar year (same as the tax year).

A second tax residency rule also applies. The “60 day rule”, has also been introduced effective as from 1 January 2017. As such, from the tax year 2017 onwards, an individual is considered a tax resident of Cyprus if the individual satisfies either the “183 day rule” and/or the new “60 day rule” for the tax year.

The “60 day rule” applies to individuals who in the relevant tax year:

- do not reside in any other single state for a period exceeding 183 days in aggregate, and

- are not considered tax residents in any other state

- and reside in Cyprus for at least 60 days and

- have other defined Cyprus ties. To satisfy this condition the individual must carry out business in Cyprus and/or are employed in Cyprus and/or

- hold an office (director) of a company tax resident in Cyprus at any time in the tax year, provided that such is not terminated during the year and maintain in the tax year a permanent residential property in Cyprus which is either owned or rented by him/her.

Other Tax advantages for individuals.

Profit form the sale of shares is exempt from Cyprus taxation provided that the assets do not include immovable property in Cyprus.

Pension received in respect of past employment outside Cyprus is taxed in Cyprus at the rate of 5% for amount that excess €3,420.

Dividents and interest are exempt from Cyprus income tax and apply only to Special Defense Contribution in case of domiciled tax resident.

No capital gains tax applies for the sale of immovable property located outside of Cyprus.

No inheritance tax applies, nor wealth tax.

The Non-Domicile status for tax purposes.

Foreigners who decide to move their personal tax residency in Cyprus, will automatically be considered as non-domiciled in Cyprus for a maximum of 17 years. Non-domicile persons who become Cyprus tax residents will be completely exempt from Special Defense Contribution tax (“SDC”).

Special Defense Contribution tax.

SDC applies on dividends , rental income and interest. As SDC tax does not apply in the case of Cyprus tax resident individuals who are non-domiciled in Cyprus, dividend and interest earned by such persons will only be taxed in Cyprus with the General Health System Tax at 2.65%.

Who can apply for the Non-Domicile status?

Any foreign Cyprus resident can benefit from the Non-Dom system since the law doesn’t impose any financial threshold or distinctions for EU and third-country nationals.